Banks collect a payment for this service, and fees vary from bank to bank, with some banks charging an incoming wire fee as well as an outgoing wire fee. If the receiving bank is not in our district, the wire goes to the Federal Reserve Bank in the receiving bank’s district before it is deposited into the receiver’s bank account. Once the wire has been issued it goes through the Federal Reserve Bank in our district with instructions for deposit into the receiving bank account. (the Fed Reference number makes the wire “traceable”. When the portal generates a Fed Reference number the wire is marked as issued and money is taken out of our bank account.

If the information received to send the wire is correct, the wire is approved and is initiated via our online wire portal. A second person in our accounting deptartment verifies all of the same information. Our accounting department ensures that we have received the funds to wire, collected the appropriate wire fee and the wiring instructions are complete. The closer orders the wire through our accounting department. The customer (buyer or seller) completes our wire transfer instructions and provides us with a voided check. There are several steps that must take place to send a wire It now connects 12 Federal Reserve Banks and 11,700 depository institutions within the US.Īfter the buyer and seller have signed all of their closing documents, the lender has authorized funding and all money for the transaction has been received (sometimes also in the form of a wire) the closer can fund the file and order a wire transfer to complete the closing.

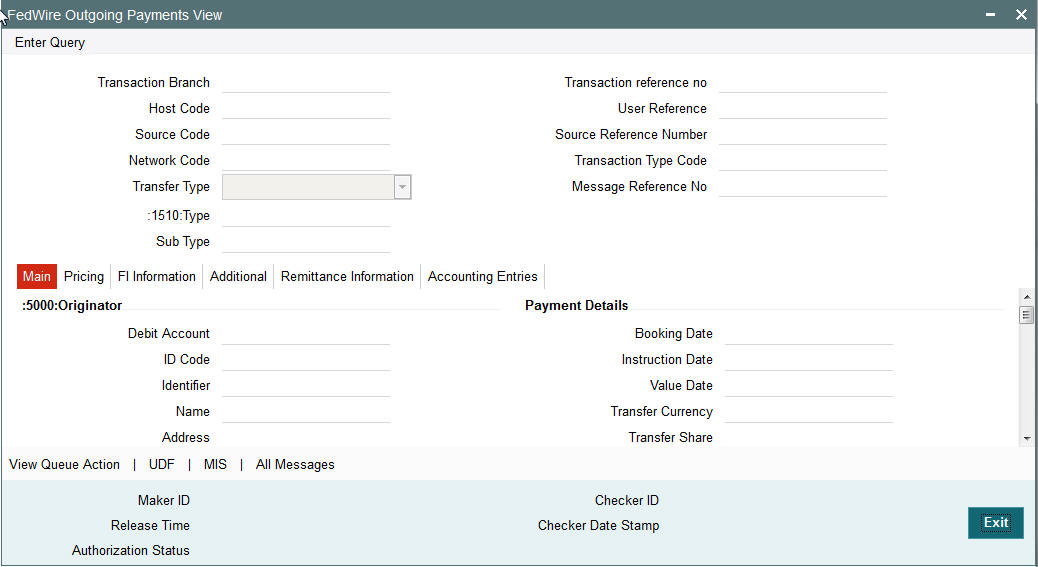

#Fed wire code

Fedwire, operated by the Federal Reserve System, began operations in 1918, originally using Morse code to send messages over leased telegraph lines.

0 kommentar(er)

0 kommentar(er)